NEWARK, N.J. – A tax preparer from Bergen County, was sentenced today to 72 months in prison for filing false federal income tax returns, stealing client refunds, and committing identity theft in connection with refunds stolen from a deceased taxpayer, U.S. Attorney Craig Carpenito announced.

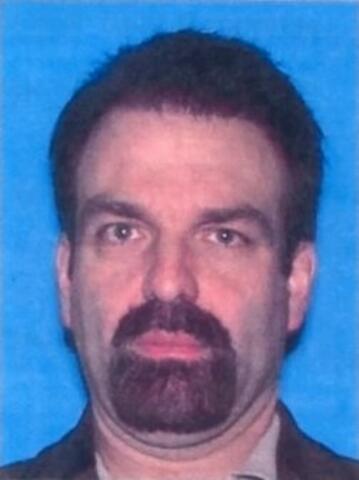

Officials say Wayne Dunich-Kolb, 54, previously pleaded guilty before U.S. District Judge Kevin McNulty to four counts of a second superseding indictment: aiding and assisting preparation of false tax returns; subscribing to false tax returns; mail fraud while on pretrial release; and aggravated identity theft.

Judge McNulty imposed the sentence today in Newark federal court.

According to documents filed in this case and statements made in court:

Dunich-Kolb operated a tax preparation business through which he prepared and filed tax returns through various tax preparation entities, including Dunich-Kolb LLC, Jadran Services Corp., Adriatica Payroll Corp., Adriatica Tax Planning LLC, and Adriatic Tax Planning LLC (collectively, the “tax preparation entities”), which he ran from his former residences in Saddle River and Montvale, New Jersey.

Dunich-Kolb also maintained a U.S. Post Office box in Las Vegas, Nevada, that he used in connection with his tax preparation business.

Dunich-Kolb caused many of his clients to form fictitious partnerships or corporations that existed in name only and had no business purpose other than to falsely reduce the clients’ tax liability.

He prepared fraudulent business returns for clients’ fictitious businesses by fabricating and inflating business expenses, such as advertising, travel and other miscellaneous expenses, in order to generate fraudulent business and partnership losses, which he then used to substantially reduce taxpayers’ taxable income on their individual federal income tax returns.

Dunich-Kolb falsified clients’ individual federal income tax returns, partnership returns, and corporation returns by fabricating and inflating: (1) business and partnership Schedule K-1 losses; (2) deductions for unreimbursed employee business expenses, including home office, vehicle mileage and fuel expenses; and (3) expenses and cost basis of rental properties, including vehicle mileage and travel expenses for rentals located within or a short distance from the primary residence.

Dunich-Kolb also falsified his own personal federal income tax returns by substantially underreporting income from his tax preparation and accounting business. For tax year 2008, Dunich-Kolb received gross income totaling approximately $638,000 while claiming income of only $489.

Dunich-Kolb also stole certain clients’ federal tax refunds, including the refunds of a deceased client, by causing the IRS to mail the refund checks to Dunich-Kolb’s Las Vegas Post Office box, from where they were forwarded to Dunich-Kolb’s residence in Montvale. Dunich-Kolb, without authorization, used the Social Security numbers of the deceased client and another client on IRS forms claiming that the latter client was entitled to the deceased client’s refunds for tax years 2013 and 2014 and causing the IRS to mail the deceased client’s refunds to his Las Vegas Post Office box. Once in receipt of the clients’ tax refund checks, Dunich-Kolb deposited the checks into accounts that he controlled and converted the funds to his own personal use.

In addition to the prison term, Judge McNulty sentenced Dunich-Kolb to three years of supervised release and ordered him to pay restitution of $2.2 million to the IRS.