By: Richard L. Smith

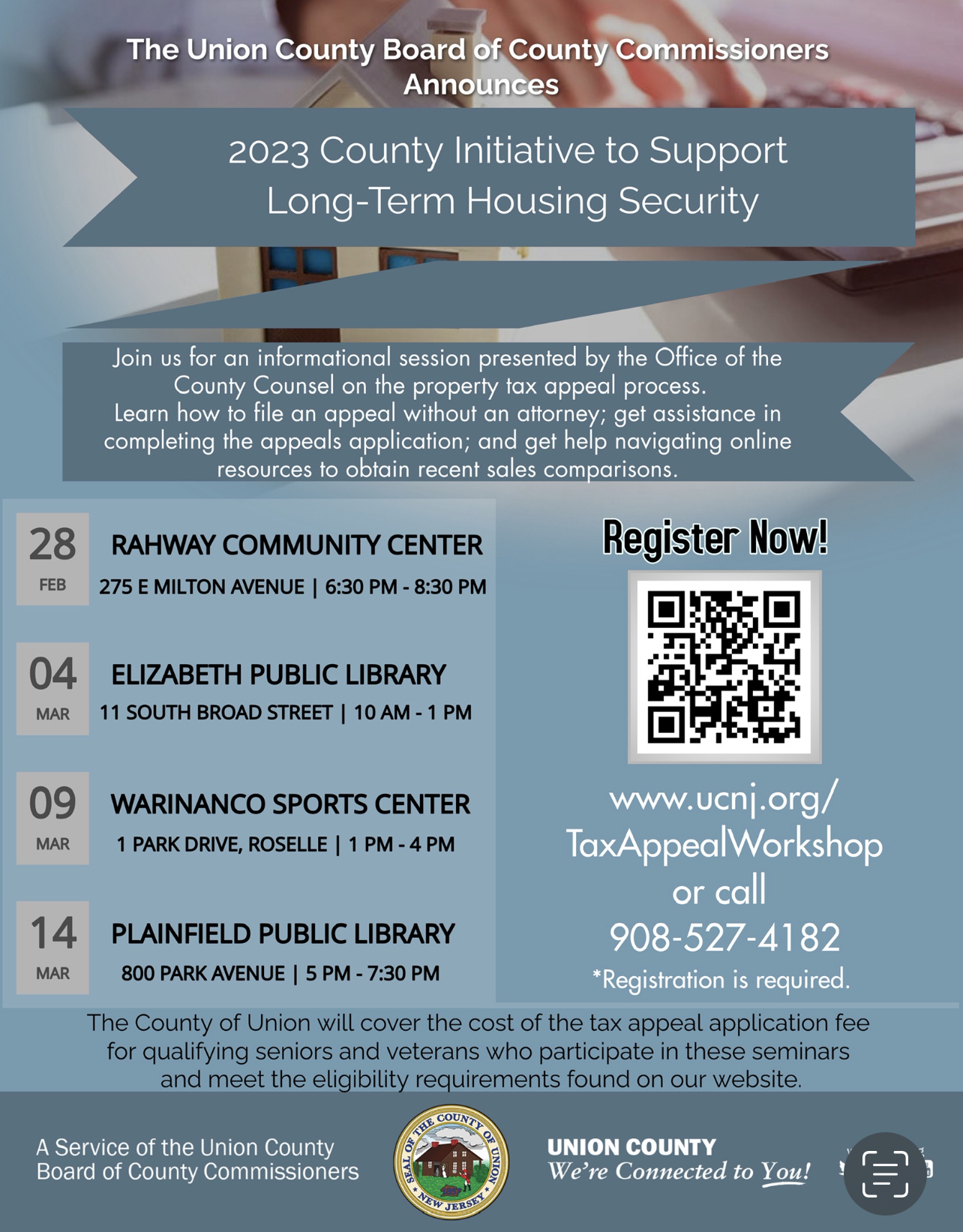

As part of the 2023 Chairman Initiatives, “Building a Stronger Union County,” the Union County Board of County Commissioners, are pleased to announce that a series of four informational sessions will be held for residents who wish to file a property tax appeal.

The new, first-of-its-kind program is designed to assist in navigating the appeal process without incurring unnecessary attorney fees as part of Union County’s commitment to supporting long-term housing security.

“Taking care of our residents is something that our Commissioner Board strives to do, and we believe that everyone can use assistance, especially when living costs are on the rise,” said Union County Commissioner Chairman Sergio Granados.

“These workshops, which include both information and filing assistance, will help ensure that people can access information on their property and possibly reduce their property taxes by appealing, all while Union County is covering the costs of the filing fee for those qualifying seniors and veterans who attend.

Together, we continue to prioritize our efforts to strengthen the programs and services offered to our residents while maintaining our strong financial footing - because we know that every dollar counts.”

Staff attorneys will conduct the sessions with the Union County Office of the County Counsel.

Attendees will learn how to file an appeal without an attorney, get assistance in completing the appeals application, and get help navigating online resources to obtain recent sales comparisons.

The sessions are free, but registration is required in advance at www.ucnj.org/taworkshop.

Please call Union County at 908-527-4182 if any additional assistance with registration is needed.

Any eligible Union County property owners can attend any of the following sessions:

Rahway: Tuesday, February 28, at the Rahway Community Center, 275 East Milton Avenue, from 6:30 PM to 8:30 PM.

Elizabeth: Saturday, March 4, at the Elizabeth Public Library, 11 South Broad Street, from 10:00 AM to 1:00 PM.

Roselle: Thursday, March 9, at Union County’s Warinanco Sports Center, 1 Park Drive in Warinanco Park, from 1:00 PM to 4:00 PM.

Plainfield: Tuesday, March 14, at the Plainfield Public Library, 800 Park Avenue, 5:00 PM to 7:30 PM.

Seniors and Veterans eligibility for a property tax waiver is based on the following qualifications:

· Must be a Union County resident

· Must be 62 years old or older or a U.S. veteran honorably discharged from the military

· Must be the property owner of record with an annual household income not greater than $65,000

· The tax-assessed value of the home must not be greater than $399,000.

Union County will cover the filing fee for qualifying seniors and veterans who attend an information session.

The fee is $5.00 for homes assessed up to $150,000 and $25.000 for homes assessed up to $399,000.

For information about other resources for seniors in Union County, visit the Union County Division on Aging at ucnj.org/aging.

Information about resources for veterans in Union County is available from the Union County Office of Veterans Affairs at ucnj.org/veterans.