By: Richard L. Smith

Newark homeowners and renters will have the opportunity to get one-on-one assistance filing for New Jersey’s property tax relief programs at a community event this week.

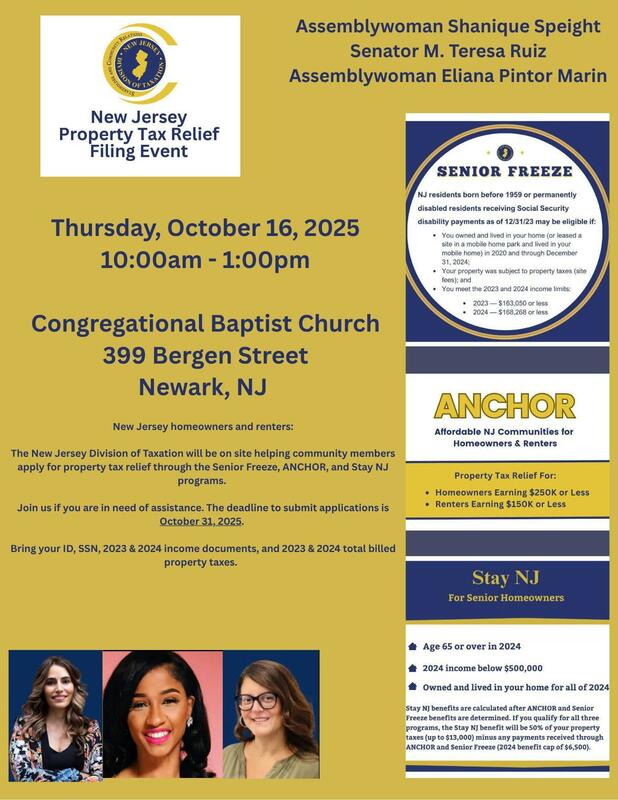

According to information released, the New Jersey Division of Taxation will be on site Thursday, October 16, 2025, from 10 a.m. to 1 p.m. at Congregational Baptist Church, 399 Bergen Street in Newark.

The session is being supported by Assemblywoman Shanique Speight, Senator M. Teresa Ruiz, and Assemblywoman Eliana Pintor Marin, who say their goal is to ensure that residents can take advantage of much-needed relief during these difficult economic times.

At the event, trained staff will help residents file applications or answer questions about three major programs:

Senior Freeze: For eligible seniors and permanently disabled residents, helping offset property tax increases.

ANCHOR (Affordable NJ Communities for Homeowners & Renters):

Available to homeowners earning $250,000 or less and renters earning $150,000 or less.

Stay NJ: Aimed at seniors 65 and older with incomes below $500,000, providing property tax reductions after other benefits are calculated.

Officials stress that the deadline to file applications for these programs is October 31, 2025.

Residents are asked to bring identification, Social Security numbers, income documents for 2023 and 2024, and their 2023 and 2024 property tax statements.

For residents under 65 who are not collecting Social Security disability benefits, the state has noted that some applications may be automatically filed online.

However, anyone who does not receive an Auto-File Confirmation Letter is encouraged to apply manually using the ANC-1 form.

“This is about keeping money in the pockets of working families and seniors,” officials said, encouraging Newark residents not to miss the filing deadline.