By: Najla Alexander

Middlesex County officials announced that the County is raising broad awareness and encouraging eligible homeowners to apply for the Stay NJ property tax relief program—a new State of New Jersey initiative that provides significant financial support to older residents.

To ensure that every eligible County resident is aware of this program, the County has recently launched a multi-faceted public service announcement campaign, highlighting the key benefits and criteria, according to MCPO officials. Additionally, for ease of discovery and for helpful tools, the County created a webpage with useful links to more information at middlesexcountynj.gov/taxrelief.

Middlesex County officials said that this campaign reflects the County's continued commitment to older residents to enable them to remain in New Jersey by easing the burden of property taxes and promoting the overall well-being of the senior community.

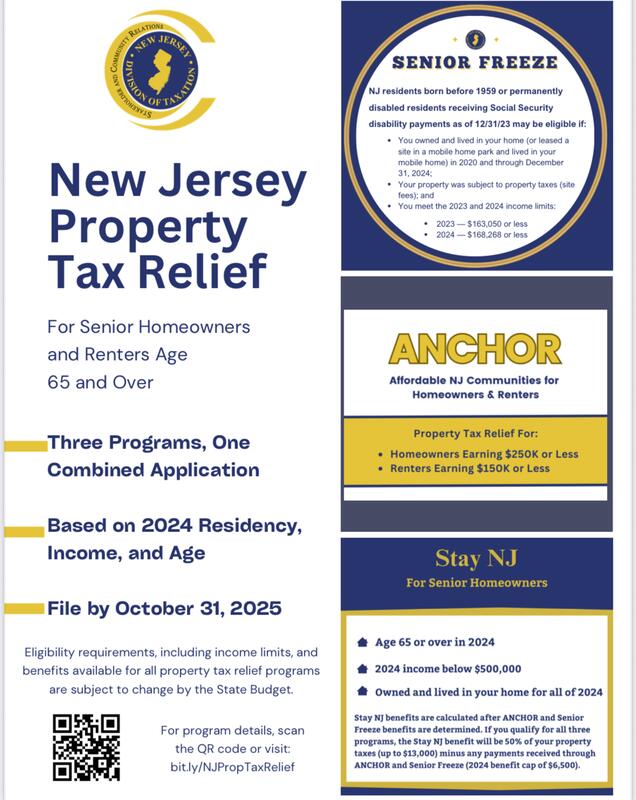

Stay NJ offers a 50% reimbursement on property taxes—up to $13,000 annually—with a cap of $6,500 for 2024, MCPO officials say. The program is available to homeowners who are 65 years of age or older and meet income and residency requirements.

The application deadline is October 31, 2025, with payments expected in early 2026, Middlesex County authorities stated. This year, residents can conveniently apply for property tax relief by submitting a single application to claim benefits for Stay NJ, ANCHOR, and Senior Freeze.

“The Stay NJ program will provide meaningful relief to our senior homeowners, helping them remain in the homes they have built and cherished within their community in Middlesex County,” said Middlesex County Commissioner Director Ronald G. Rios.

Commissioner Claribel A. Azcona-Barber, Chair of the County’s Community Services Committee, said, “We want our older residents to know that they are not alone. Whether you need help with the application process or need key property details, we’re here to help—every step of the way.”

“Middlesex County is here to assist residents as they apply for the Stay NJ program by making the process more accessible through online tools on our County website,” said Middlesex County Clerk Nancy J. Pinkin.

According to Middlesex County officials, to aid with the application process, the Office of the County Clerk, along with the Office of Information Technology, offers two web-based tools: the Middlesex County Tax Relief Program Address Lookup and the Middlesex Clerk Records Search Tool, both available on middlesexcountynj.gov/taxrelief.

These tools allow residents to search for information about their property, including their block and lot numbers, MCPO officials say.

The Middlesex County Office of Aging & Disabled Services will conduct outreach efforts county-wide to educate older residents about this vital program and provide support during the application process, Middlesex County authorities stated.

Middlesex County officials said as a designated AARP Age-Friendly Community, Middlesex County helps older adults stay engaged with the community through various services and programs offered by the Office of Aging & Disabled Services, including meal services, health and fitness events, fraud prevention and elder abuse conferences, an annual art contest and show, and more.

For more information on programs and services provided by the Office of Aging & Disabled Services, please visit middlesexcountynj.gov.