Federal officials are a reassuring New Jersey and US residents that their 2018 tax returns will be processed and returns -if any- sent on time amid the nations government shutdown that's in effect.

According to a published report in the Washington Post, "The White House on Monday directed the Internal Revenue Service to pay tax refunds to millions of Americans during the federal shutdown, marking its most dramatic reversal yet of past legal precedent as officials scramble to contain public backlash from the funding lapse."

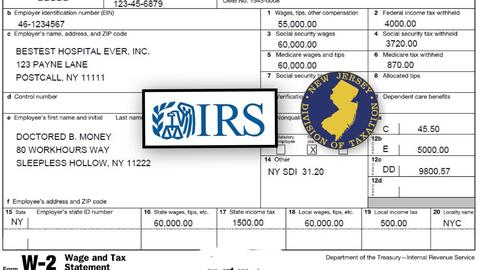

In New Jersey, form **W-2, Wage and Tax Statement**, shows your income and the taxes withheld from your pay for the year. Most people get their W-2 forms by the end of January. You need it to file an accurate tax return according to The NJ Division of Taxation.

Reporters for the January 7th Washington Post publication said the decision not to allow tax returns to process could prove extremely consequential for U.S. households and the U.S. economy. Last year, between Jan. 29 and March 2, the IRS paid more than $147 billion in tax refunds to 48.5 million households.

President Trump's administration lawyers ruled Monday that the refunds could be processed after an incident last year, and during previous administrations, the IRS said it would not pay tax refunds during a government shutdown according to reporters from the Washington Post.

**INFORMATION CREDIT:** The Washington Post January 7, 2018 publication.