FREEHOLD – A Middlesex County man with an Englishtown-based accounting firm is charged with stealing about $385,000 in tax payments from a wholesale distributor now based in South Carolina, announced Monmouth County Prosecutor Christopher J. Gramiccioni.

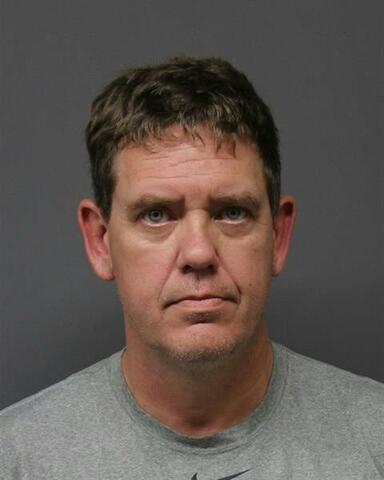

According to officials, Mr. William A. Berry, of South Plainfield, was arrested and charged Tuesday with second-degree Theft by Failure to Make Required Disposition. Berry was arrested with assistance from the Englishtown Police Department following a 10-month investigation by the Monmouth County Prosecutor’s Office.

If convicted, Berry faces up to 10 years in a New Jersey state prison.

Berry, who will be 49 years old next week, is the owner of William Berry & Associates, an accounting and tax preparation business in Englishtown. The investigation found Berry stole funds in the aggregate amount of $385,000 for his personal use from the victims between March 2017 and July 2019.

The investigation revealed Berry received funds from the victims’ personal and business banking accounts for the purposes of remitting federal and state quarterly taxes on behalf of the victims. In turn, Berry failed to remit tax payments to the proper tax collecting authorities.

The Monmouth County Prosecutor’s Office was contacted in December 2019 by a civil attorney for victims, the owners of a multi-million-dollar wholesaler distribution company that specializes in holiday décor currently based in Charleston, South Carolina.

The victims, former New Jersey residents, were subsequently contacted by law enforcement and reported hiring Berry to file and remit corporate taxes for their business after their former accountant retired.

The victims reported having previous business dealings with Berry at his Englishtown-based practice. The investigation revealed Berry corresponded with the victims to advise them of the amounts to be remitted to the federal and state tax collection authorities on a quarterly basis.

The victims sent funds between March 2017 through July 2019 at the direction of Berry, from their Bank of America accounts to a Wells Fargo bank account held in the name of William Berry and Associates.

The victims received subsequent notifications from the State of South Carolina and the Internal Revenue Service for failure to file and remit taxes for the years 2017 and 2018.