All the information in this report is verbatim and was supplied by The NJ Office of the Attorney General Division of Gaming Enforcement.

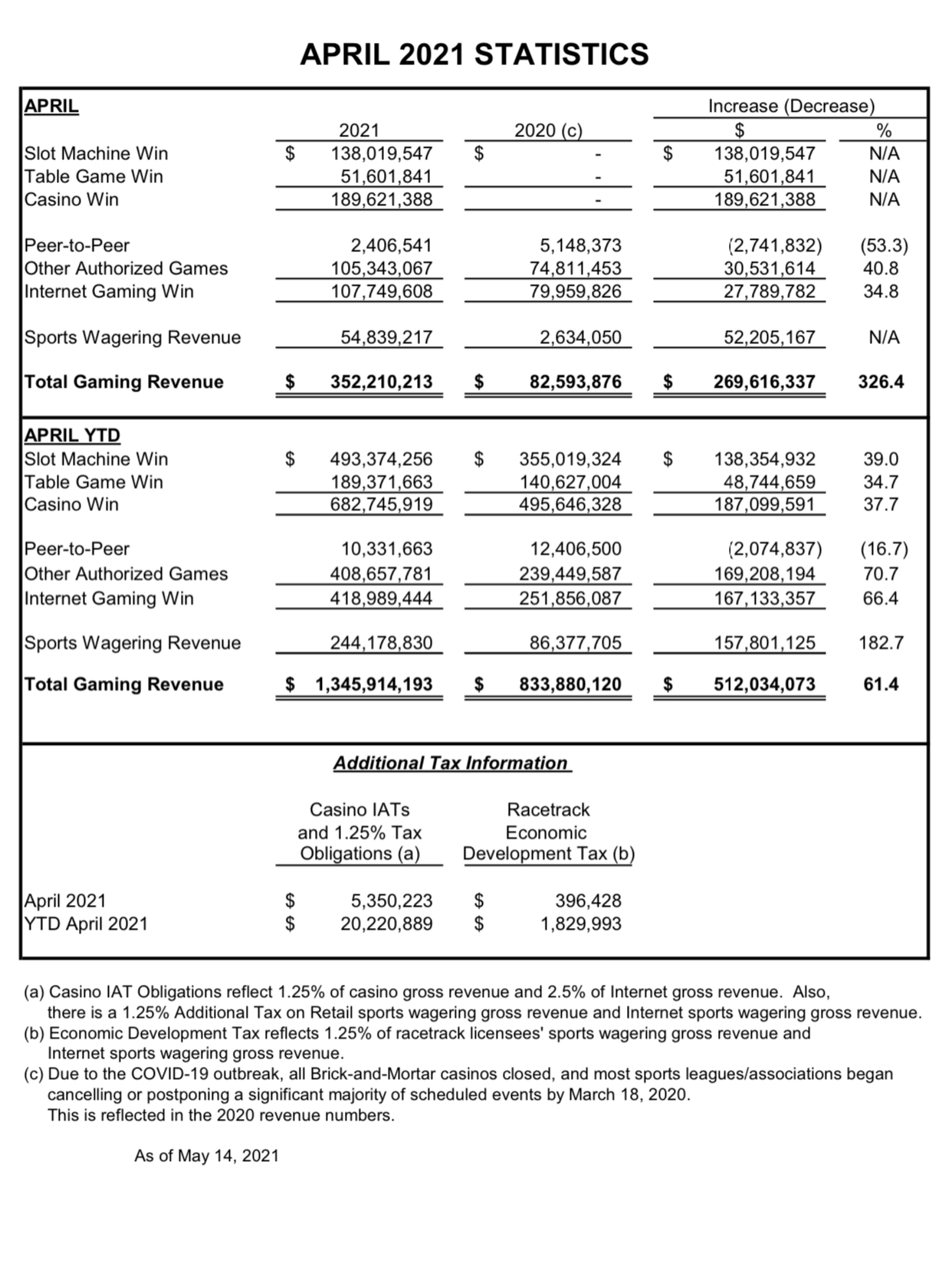

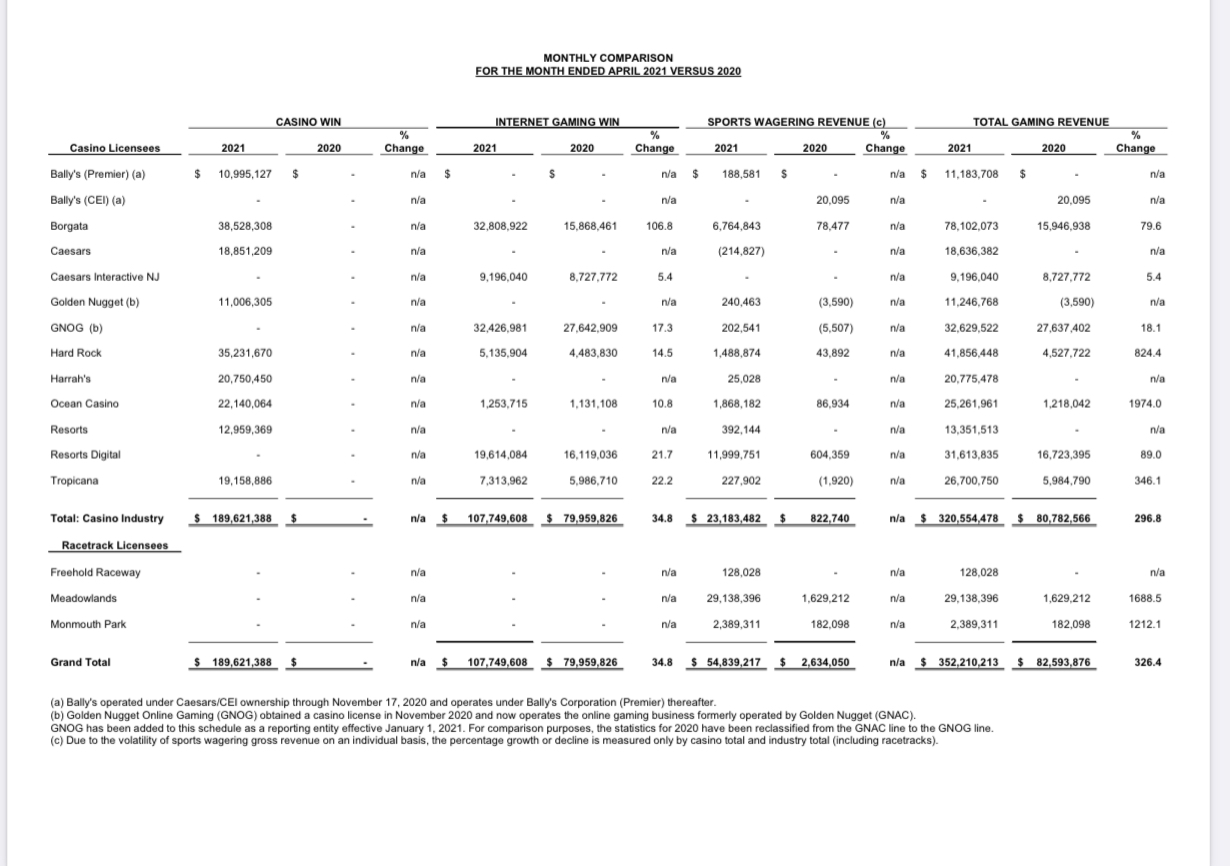

Based upon filings with the Division of Gaming Enforcement, Total Gaming Revenue for April was $352.2 million compared to $82.6 million in April 2020, reflecting a 326.4% increase.

Internet Gaming Win was $107.7 million in April compared to $80.0 million in the prior period, reflecting an increase of 34.8%.

Sports Wagering Gross Revenue was $54.8 million for the month. Casino Win for April was $189.6 million. (See Note below.)

For the first four months, the Industry’s Total Gaming Revenue was $1.35 billion compared to $833.9 million, reflecting an increase of 61.4%. Internet Gaming Win increased 66.4% to $419.0 million when compared to the prior period.

Sports Wagering Gross Revenue was $244.2 million. Casino Win for the period was $682.7 million (See Note below.)

NOTE: Due to COVID-19, Atlantic City Casinos closed at 8:00 PM on March 16, 2020. Internet Casino Gaming and Online Sports Wagering operations continued, however, most sports wagering events were canceled beginning in mid-March 2020.

As a result, Casino Win and Sports Wagering Revenue for the month and the year-to-date period ended April 2021 are not comparable to 2020.

Additionally, the Atlantic City Casino Hotel properties continue to operate under COVID-19 restrictions since reopening in July 2020.

Tax Information:

For the month of April 2021, total gaming taxes were $36.0 million.

Total gaming taxes reflect 8% of taxable casino gross revenue, 15% of Internet gaming gross revenue, 8.5% tax on casino and racetrack sports wagering gross revenue and 13% tax on casino and racetrack sports wagering Internet gross revenue.

In addition, the casino industry incurred $5.4 million in 1.25% Additional Tax on sports wagering gross revenue and Investment Alternative Tax Obligations (which reflects 1.25% of casino gross revenue and 2.5% of Internet gaming gross revenue).

For the month of April 2021, the Racetrack Economic Development Tax of 1.25% of racetrack sports wagering gross revenue was $396,428.

FOOTNOTES:

- Total Gaming Revenue consists of Casino Win, Internet Gaming Win and Sports Wagering Gross Revenue.

Sports wagering statistical information is unaudited and subject to adjustment.

The statistical completed events Win and Handle information is provided by each casino/racetrack licensees’ platforms operating under its sports wagering license.

Additional Information:

Gross Revenue Reports (DGE website):

Internet Gross Revenue Reports (DGE website):

Sports Wagering Revenue Reports (DGE website):

Tourism Data (CRDA website):

http://www.nj.gov/oag/ge/mgrtaxreturns.html

http://www.nj.gov/oag/ge/igrtaxreturns.html

http://www.nj.gov/oag/ge/swrtaxreturns.html

http://www.atlanticcitynj.com/about/stats.asp