Acting Attorney General John J. Hoffman announced that a Middlesex County man pleaded guilty today to conspiring with a doctor in sophisticated fraud and money laundering schemes by which the physician hid approximately $3.6 million in income from his medical practices to evade taxes. He also pleaded guilty in connection with two schemes to pay illegal kickbacks to doctors.

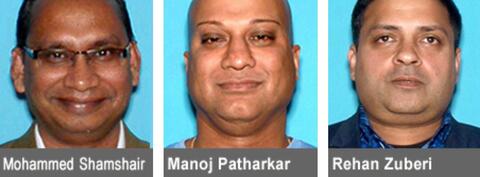

Mohammed Shamshair, 52, of Sayreville, pleaded guilty today to charges of first-degree conspiracy and first-degree money laundering before Superior Court Judge Michael A. Toto in Middlesex County. He admitted his role in the criminal scheme that allegedly enabled the doctor to evade about $327,000 in taxes owed to the State of New Jersey. Under the plea agreement, the state will recommend that Shamshair be sentenced to eight years in prison on those charges.

Sentencing is scheduled for May 16. Shamshair was charged in an Aug. 24, 2015 indictment that also names the doctor, Manoj Patharkar, 44, of South Amboy, and his corporations, Pain Management Associates of Central Jersey and Prospect Pain Management Associates. Dr. Patharkar faces pending charges that include, among others, conspiracy (1st degree), two counts of money laundering (1st degree), theft by deception (2nd degree) and multiple counts of filing fraudulent tax returns and failure to pay taxes (all 3rd degree).

Shamshair also pleaded guilty today to two separate accusations charging him with second-degree conspiracy to commit commercial bribery. In pleading guilty to one accusation, he admitted that he paid illegal cash kickbacks totaling as much as $1,560,000 to 12 doctors, who were not named, on behalf of Patharkar, in return for the doctors referring patients to one of Patharkar’s pain management clinics.

Shamshair admitted that he and Patharkar paid the kickbacks using cash generated through the money laundering schemes addressed in the indictment. In pleading guilty to the second accusation, Shamshair admitted he acted as a middle man in a similar kickback scheme on behalf of Rehan Zuberi, who pleaded guilty in May 2015, along with his wife, in a case brought by the New Jersey Office of the Insurance Fraud Prosecutor (OIFP). Zuberi, who faces a recommended sentence of 10 years in prison, admitted that he bribed dozens of doctors in return for referrals worth millions of dollars to the medical imaging centers he and his wife owned and operated.

In pleading guilty today to his role in that scheme, Shamshair admitted that he delivered more than $200,000 in kickbacks to 10 unnamed doctors. The state will recommend that he receive a concurrent eight-year prison sentence on each of those charges.

In the indictment charging Patharkar and Shamshair, the state alleged that Patharkar used two separate schemes to launder $3.6 million through his practices, Pain Management Associates of Central Jersey in Edison and Prospect Pain Management Associates in Passaic. In the first scheme, Patharkar allegedly reduced his income tax obligations by fabricating the existence of employee payroll and wage expenses. Shamshair secured the personal identifying information of about 28 people, including Social Security numbers, names, dates of birth, and addresses. These 28 people became “phantom employees” for both practices. To give the scheme a semblance of legitimacy, Patharkar allegedly issued at least 1,574 checks totaling $2,184,642 made payable or otherwise attributable to these 28 phantom employees.

In May 2015, another associate of Patharkar, Irfan Raza, 45, of Valley Stream, N.Y., pleaded guilty to second-degree conspiracy for also assisting in the scheme by providing personal identifiers for the phantom employees. Raza, a certified public accountant, admitted to helping Patharkar and Shamshair launder the doctor’s income in exchange for a cut of the illicit funds.

In the second scheme, Patharkar received approximately 4,310 checks totaling $1,413,511 from various companies and persons, including several national and regional insurance carriers, for medical services he provided. Patharkar allegedly deposited those checks into his personal bank accounts and did not claim those funds on his personal or corporate tax filings. The charges pending against Patharkar and his corporations are merely accusations and the defendants are presumed innocent until proven guilty.